Renters Insurance in and around Youngstown

Welcome, home & apartment renters of Youngstown!

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented apartment or space, renters insurance can be the right decision to protect your stuff, including your silverware, microwave, running shoes, books, and more.

Welcome, home & apartment renters of Youngstown!

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

Renting a home is the right choice for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance could cover the cost of damage to the structure of your rented home, but that doesn't cover the repair or replacement of your belongings. Renters insurance helps safeguard your personal possessions in case of the unexpected.

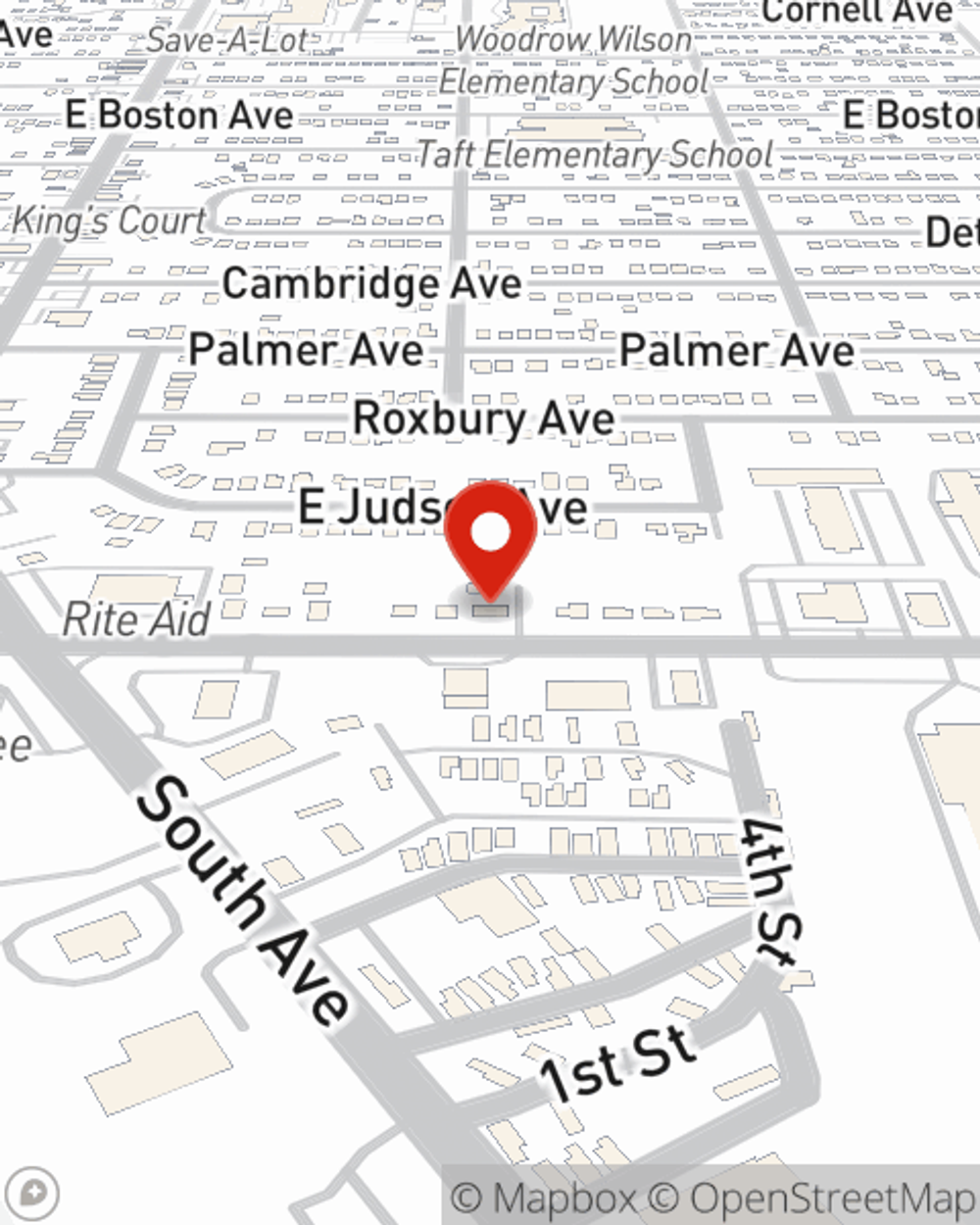

More renters choose State Farm® for their renters insurance over any other insurer. Youngstown renters, are you ready to discover the benefits of a State Farm renters policy? Contact State Farm Agent Steve Jones today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Steve at (330) 788-0500 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Steve Jones

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.